HVACR sales show marked differences in 2014

14th September 2015

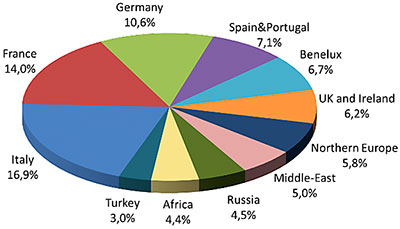

While sales figures for HVACR equipment across Europe, the Middle East and Africa in 2014 show improvements, there were marked differences across countries.

The figures for 2014 from Eurovent Market Intelligence (EMI) are drawn from figures supplied by over 280 manufacturers cover a number of product groups including fan coils, chillers, rooftop units, precision ac, air handlers and cooling towers.

Sales of fan coils were typical of the striking differences across markets. While the UK, Benelux, Italy (the largest market), Germany, Russia, and the Middle East all experienced declines of between 10% and 15%, sales improved in France and Spain, with increases of 3% and 9% respectively, compared to 2013. Sales in Turkey slowed and stabilised at around 5% but Africa was far more successful, seeing a growth of 16%.

The total number of fan coils sold in the EMEA region last year was 1.35 million units, a 6% drop on 2013.

Rooftops

Around 67,000 rooftops were sold in the EMEA region last year – 12% up on 2013. Sales improved in France and Italy, with 18% and 7% growth respectively, while the situation deteriorated considerably for Spain and Turkey, which suffered declines of 15% and 30%.

The rooftop market is still dominated by the Middle-East with an 80% market share. Within this region, Saudi Arabia has 40% of the market followed by the UAE with 23%. In addition, these two countries are said to have experienced growth of 35% and 7% respectively compared to 2013. In Europe, it is France, Spain, Turkey and Italy who have the largest market share.

Looking forward, EMI expects the market growth in rooftop units to continue in 2015, but at a more moderate pace than in 2014.

Chillers

EU countries experienced the major growth in chiller sales last year. Increases in France, Spain and the UK were between 8% and 10%. In Germany, growth reached 3%, but Italy, the Middle East and Turkey experienced a slight decline of 1%.

The markets for machines less than 700kW is dominated by the EU with an average market share of 85%. Italy is dominant with a market share of 47% for less than 50kW and 17% for 50-700kW. France, Germany, and the Iberian Peninsula follow with market shares of around 10%.

Predictably, the Middle East leads the large capacity market with a 30% share, followed by Turkey with 12%.

Computer room air conditioners

The CRAC market was reported as static last year. The 30,000 units sold remained unchanged from 2013. The market is dominated at 80% by Europe. Germany lead the market share in 2014 with 12%, followed by the UK (11.3%), the Middle East (11%) and Italy (10.3%).

Growth was strong in Italy and the Middle East, with increases of around 20%. On the negative side, France saw an 8.4% decline, with Russia experiencing a decrease of 20%.

EMI expects a growth of 2.5% this year, with positive forecasts for the market-leading countries and improvements in France.

Air handling units

The air-handling unit market amounted to €2.05bn in 2014, a 1.4% increase on 2013. Growth was driven by the Scandinavian countries, the second largest market in Europe at €324.82m – a 16% market share and an annual increase of 2.6%.

Disappointingly, Germany, the market driver for the air-handling units with €360.27m units sold this year, experienced a decline of 3.3%, followed by France, who dropped by 5.4%.

Air filters

The market for filters was again depressed, amounting to €1,084m for the EMEA region against €1,081m the previous year. The only EU countries showing favourable growth were Denmark and the UK, each showing growths of 9%. In contrast, France, Sweden, Finland and the Iberian Peninsula suffered declines between 1% and 3.4%. Turkey recorded a growth of 9% while the Middle East clearly pulls ahead with an increase of 23%.

Germany is the largest market at 22%, followed by the Scandinavian countries, who, together, represent 15% of the European market. France is in third position with 12%.

Heat exchangers

Heat exchanger sales increased 3.5% compared to 2013, reaching €837m.

Germany remains the largest market with sales of €143.4m – an increase of 4.5%. Italy is in second place with an 11% market share and an annual growth of 10%. Russia is closely behind with 9% of the market then France and the UK with 8% each. The largest increase recorded outside the European Union was by Turkey, with 25%.

Cooling towers

The cooling tower market was worth €232.67m in 2014, a slight increase on last year.

The EMEA region market leader is Germany, with 17%, but is closely followed by the Middle East and its 15% market share. The Italy/France/UK trio is just behind with market shares of around 7%.

Adiabatic coolers

Described by Eurovent in its its report last year as an emerging market, sales of adiabatic coolers grew by around 20% in 2014.

Almost all countries experienced an increase, with the exception of Spain and Poland which experienced a slight decline. The market leaders are Germany and France with market shares of around 20%. Followed by Switzerland, Eastern Europe and Russia.

For further information visit the Eurovent Market Intelligence website.