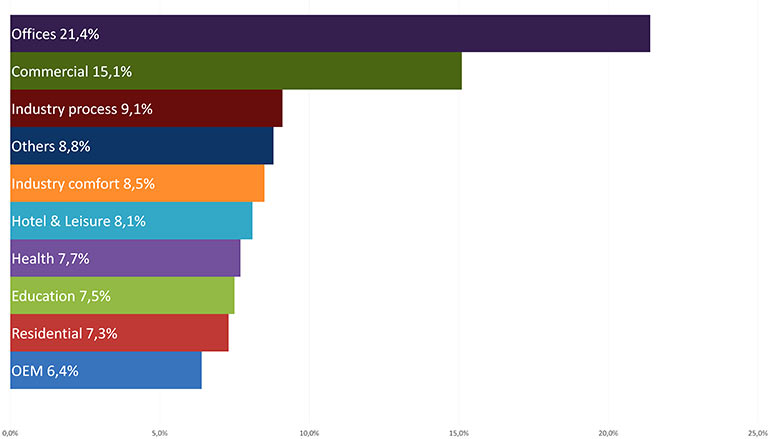

European VRF sales grow 7% in 2018

28th July 2019

FRANCE: VRF air conditioning sales in Europe grew by 7% last year, reaching 216,135 units.

Large increases of 30% were seen in Portugal and Romania, whereas the largest decreases were in Norway and Lithuania, with declines of around -30%.

The figures are contained in the latest survey of HVAC sales in Europe, Middle East and Africa (EMEA) published by Eurovent Market Intelligence (EMI).

The principal European VRF markets are, in order of size, Turkey, France, Italy and Spain, totalling 108,744 units. Northern Europe still lags far behind with only 1,327 units sold in 2018.

High-capacity VRFs with a capacity of more than 50kW saw the largest increase, rising from 11.2% in 2017 to 14.1% in 2018. Though there are significant variations across countries, cassettes were the most popular indoor unit (42%) overall, followed by ducted units (30%) and wall units (21%).

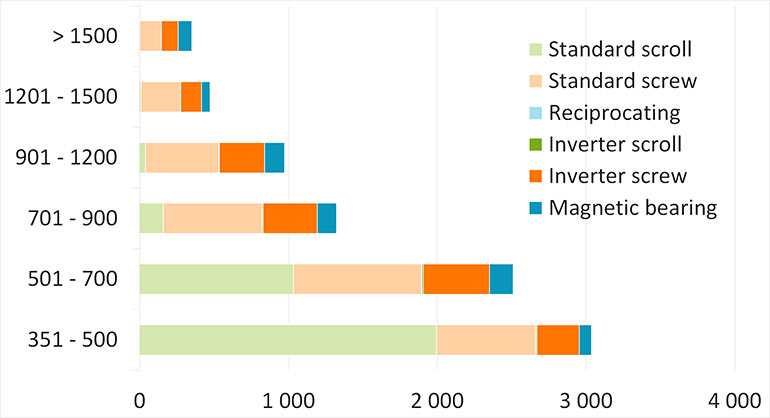

Chillers

The European chiller market (including reversible) reached €2.2bn in 2018, with a 5% increase in units with a capacity greater than 50kW compared to 2017. The market for units under 50kW continues to be dominated by reversible heat pumps and is predominantly in France, Germany and Italy with a total of 228,000 units sold in these three countries. The same countries are also the main markets for units over 700kW, with a total of 1,231 units sold.

While new lower GWP refrigerants like R513A and R1234ze) have grown rapidly in comparison with 2017, they still only make up 1% of the units sold in Europe. The market continues to be largely dominated by R410A and R134a.

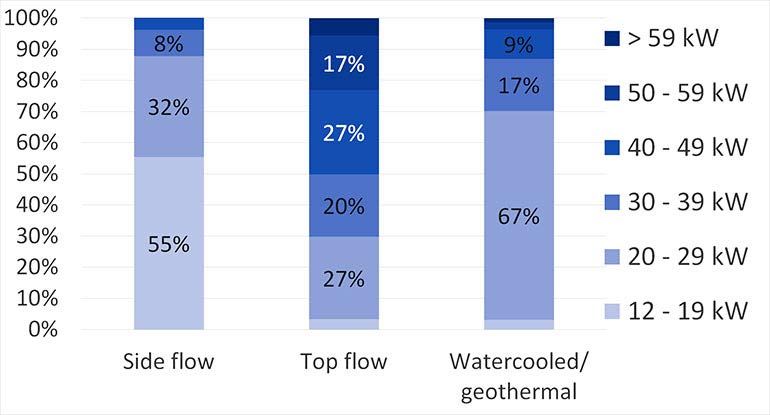

IT cooling sector

The IT cooling market rose to €427m in the EMEA region in 2018, comprising 58% room air conditioners, 19% self-contained air conditioners (row and rack coolers), 10% mobile and 13% AHUs. The largest markets are Germany with €63.1m, UK with €53.2m, France with €32.1m and Italy and Russia with €24m each.

Fan coils

The fan coil market was relatively stagnant in Europe between 2017 and 2018, levelling off at about 1.35 million units. This was partly attributed to the sharp decline in Turkey (-24.9%) and, to a lesser extent, a decrease in Russia (-7.1%). By contrast, the EU experienced an increase of +4.6%, mainly explained by large increases in Spain and the UK (+6.5% and +13.1%, respectively) and by a stable Italian market (+2.4%). Portugal experienced the largest increase between 2017 and 2018, with sales up more than 40% to 15,900 units.

The most dynamic types of fan coils were cassette and wall models, as well as 4-pipe units. Despite these large increases, the market remains dominated by 2-pipe units (73% of models).

Rooftop units

The European rooftop unit market experienced a decrease of more than 12% in 2018, amounting to about 11,500 units. Turkey remained dominant with 2,100 units sold in 2018, representing an increase of +4%. Despite declining by -15.3%, -17.4% and -6.1% respectively, France, Italy and Spain remain the next three largest European markets, each with more than 1,500 units sold.

Medium capacity units, between 17 and 120kW, represent three-quarters of sales in Europe. Reversible rooftop units remain the preferred type in Europe, with about 70% of the market. Cooling-only units also seem to have gained ground, accounting for almost 17% of sales.

Air handling units

The European air handling unit market reached €2.1bn after a small increase in 2018 (3.3%). This increase came mainly from four of the biggest European markets: Germany, which remains the leader with €422m (+0.9%), followed by Northern Europe with €362m (+3.8%), Eastern Europe €261m (+14%) and Turkey €149m (+11.1%). Declines were seen in Russia and the CIS (€129m, -14%) and the UK (€237m, -10.7%).

Heat exchangers

The heat exchanger market continued to grow in 2018, reaching around €940m, of which about 3% were adiabatic. This increase has been driven by the main European markets: Germany, Italy, France and Spain, which recorded growths of around +10%.

Air-cooled heat exchangers continue to gain ground and represent 34% of the market in this year. The rest of the market is composed of evaporative coolers (35%), condensers (18%) and CO2 gas-air heat exchangers (13%).

The heat exchangers market is dominated by commercial refrigeration (39%), followed by industrial and comfort applications, with 26% and 21% of the market respectively.

Chilled beams

The chilled beams market continues to fall – by 6% this year to €54.4m. This decrease was spurred by the countries that traditionally represented the bulk of the market, such as Sweden, the UK and France. These countries, with a market share of 51% in the EU, saw declines of -5% for Sweden and -30% for the UK, as a result of Brexit. Other regions, like Italy, Belgium and the Baltic countries also recorded negative movements. Conversely, Denmark, Spain and, outside of the EU, Switzerland and Russia have also benefited from increases of more than 40%.

Active chilled beams, which constitute 93% of sales, remain the most used in Europe. Among these, 76% are integrated and 24% are autonomous.

Air filters

The growth in air filters in the EMEA market subsided in 2018, with total sales of around €950m. The two biggest countries, Germany and France, who jointly represent 40% of the market, recorded a slight decrease of around -2%, whereas the UK and Italy increased by 4%.

Cooling towers

The European cooling towers market was buoyant, growing by 16% in 2018 to €131.3m. Five countries represent two-thirds of the European market: Germany, Italy, France, the UK and Poland. All of these countries recorded an increase in sales, the highest being recorded in Poland where the growth reached 25%.

Outside of the EU, the biggest markets were the Arabian Peninsula (around €20m), Turkey (about €14m) and Russia (almost €9m). However, the market only increased in Russia between 2017 and 2018, whereas the Arabian Peninsula and Turkey experienced a significant decrease in their sales.

Open cooling towers were the most popular in most European countries. Only the Baltic countries, Belgium, France and Romania preferred closed circuit towers.

Air curtains

The air curtain market saw an increase of 6% in 2018 and reached 83,000 units sold. In the EU, 91% of air curtains were sold in the design, commercial and retail markets, whereas only 9% were destined for industry and cold rooms.

Electrically heated air curtains are the most popular in the European Union and represent almost half of the market. Units with refrigerant remain less popular for the moment and have a market share of around only 2%.